Closing the books at the end of each month, quarter, or year is demanding for accounting teams. The pressure to meet tight deadlines while ensuring accuracy often leads to long hours and increased stress. However, by adopting best practices and leveraging technology, you can significantly streamline your financial close process and alleviate many of these challenges.

The Challenges of Closing

The financial close process is stressful due to the large volume of data and the need for precision. Teams face tight deadlines to reconcile accounts and prepare financial statements, all while maintaining accuracy and compliance with GAAP issued by the FASB, GASB, or IFRS. Key challenges include:

- Tight Deadlines: Limited time to complete reconciliations and reporting.

- Data Accuracy: Ensuring all entries, especially accruals, and prepaids, are complete and accurate, meeting GAAP standards.

- Cross-Department Coordination: Delays or miscommunication with other departments can slow the process.

- Manual Processes: Relying on spreadsheets increases errors and extends the close cycle.

- Compliance and Reporting: Meeting regulatory requirements while preparing for audits adds extra pressure.

Organizations that use automation and technology for financial close can often finish in half the time, highlighting the value of efficient processes.

The Promise of Efficiency

Accelerating the financial close is about creating efficiency, reducing stress, and improving accuracy. A faster close enables accounting and finance teams to focus on strategic initiatives, leading to the following:

- Improved Productivity: Streamlined workflows allow teams to manage their time better and focus on high-impact tasks.

- Fewer Errors: Automation reduces mistakes, improving the completeness and accuracy of financial reporting.

- Increased Confidence: Reliable financial statements build trust with stakeholders and auditors.

- Greater Agility: A quicker close enables organizations to respond faster to financial changes.

- Better Resource Allocation: Time saved can be redirected to strategic initiatives.

- Enhanced Compliance: Following best practices ensures regulatory adherence and reduces the risk of penalties.

Best Practices for Accelerating Your Close

1. Leverage Automation and Technology

Automate Routine Tasks: Use software like FinQuery Contract Management to automate recurring tasks like amortization schedule creation, journal entries, and reconciliations for prepaid and accrued expenses. Automation reduces manual work and errors.

Integrate Systems: Ensure your ERP system integrates with other financial tools like lease accounting or contract management software to streamline data flow and improve efficiency.

2. Centralize Data and Documentation

Use a Single Source of Truth: Implement centralized systems for contracts, invoices, and financial data. A unified platform reduces time spent gathering information and minimizes discrepancies.

Standardize Procedures: Create and enforce consistent, company-wide processes for documentation, reconciliation, and reporting.

3. Shift Tasks out of Close

Shift tasks out of financial close: Streamline your month-end close and focus on what matters most by using a solution like FinQuery. Schedule your prepaids and accruals throughout the month and automate the outputs you need at closing. This will free up valuable time and resources for your team.

Setup Accounts and Allocations: Instead of spending valuable time allocating prepaid and accrued expenses to your financial segments during close, set up all the account coding and allocations once at the contract level and let a system like FinQuery automate those outputs for you during close.

4. Prioritize Communication and Collaboration

Cross-Department Coordination: Establish clear lines of communication between accounting, finance, and other departments to gather data promptly. This ensures timely access to necessary information for accurate reporting.

Close Checklist: Develop a checklist for each close period to track progress, assign tasks, and ensure nothing is missed during the process.

5. Plan for Peaks in Workload

Stagger Deadlines: Spread out internal deadlines across financial close to avoid bottlenecks throughout the process.

Allocate Resources Wisely: Identify key times of heavy workload and ensure adequate staffing and resources are available to handle the close process. Leveraging financial contract management software alleviates the amount of human resources required and automates tedious tasks.

6. Review and Improve Processes Regularly

Post-Close Analysis: After each close, conduct a review to assess what worked well and identify areas for improvement. Regularly refining processes ensure continual improvements over time.

Set Realistic Timelines: Evaluate the time required for each stage of financial close and adjust deadlines where needed to reduce stress and improve accuracy.

7. Use Contract-Based Prepaid and Accrual Accounting

Automate Prepaids and Accruals: Transition from a limited invoice-based approach to a more holistic, contract-based approach, where prepaids are automatically tracked, expensed, and allocated and accruals aren’t missed.

The Role of Financial Contract Management Software

Financial contract management software is essential for streamlining the close process by integrating contract data with prepaid and accrual accounting. Traditionally, accounting teams often face delays and inaccuracies while waiting for invoices to recognize expenses. Automating expense recognition based on contract terms improves efficiency and accuracy in financial reporting regardless when the invoice is received. This automation accelerates financial close and minimizes the risk of manual errors and missed deadlines.

Centralized Data Management

A key benefit of financial contract management software is the centralization of contract data. Using different systems or manual spreadsheets to track prepaids and accruals can create inefficiencies. A dedicated contract management system consolidates all relevant information in one place, saving time spent searching for key data and correcting errors. With all vendor contracts, payment schedules, and important dates easily accessible, finance and accounting teams can overcome the chaos of manual tracking.

Automating Prepaids and Accruals

Financial contract management software automates repetitive and tedious prepaid calculations, removing the need for manual tracking and workbooks. This automation ensures accurate tracking and reporting of prepaid expenses and accrued liabilities, allowing accounting and finance teams to focus on higher-value tasks like analysis and strategic planning. By integrating these automated processes into the financial close workflow, organizations can significantly reduce the time and effort needed to finalize their financial reporting each period.

Visibility and Reporting

A key feature of financial contract management software is visibility into prepaid asset and accrued liability balances, enabling proactive financial management. This ensures all contract-related expenses are accounted for, avoiding last minute surprises and leading to smoother financial closes. The software also simplifies the generation of key financial reports, giving a comprehensive view of a company’s financial landscape. Reports that include expense forecasting, balance sheet rollforwards, and payment forecasting are easily accessible, allowing finance teams to analyze performance across various timeframes. These reports offer actionable insights that support informed decision-making for both short-term trends and long-term forecasts.

Eliminating Surprises and Spotting Discrepancies

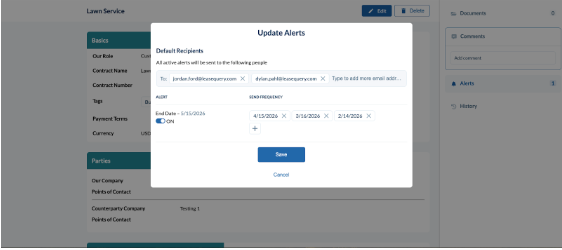

Beyond reporting, financial contract management software adds value by providing early alerts for contract renewals and identifying discrepancies. Organizations can avoid surprises from auto-renewals, as the system notifies users in advance, allowing for renegotiation or vendor changes if needed. By extracting payment schedules and terms from contracts, the software makes it easier to spot hidden or inaccurate charges, ensuring accurate budgeting and preventing costly mistakes. This transparency enables businesses to maintain better financial health and enhance forecasting.

Conclusion

Adopting financial contract management software with prepaid and accrual functionality can transform your close process. By centralizing data, automating tedious calculations, and providing real-time insights, these tools streamline operations, reduce errors, and enhance financial reporting. Investing in such technology not only improves the close process but also strengthens overall financial health and agility.