ASC 410, Asset Retirement and Environmental Obligations, defines an ARO as a liability for the costs to return a tangible long-lived asset to its original condition upon disposal. A legal obligation to retire the asset, whether by law or a binding contract between two parties, must exist. When identifying AROs, companies with leased assets should be cognizant of any modifications made to a leased asset for which the lease agreement requires the asset to be returned to the lessor in its original condition.

Accounting for asset retirement obligations

Upon determining an ARO is present, entities should initially measure the fair value of the liability as of the date the obligation is incurred. If the liability cannot be reasonably estimated when the obligation is incurred, the entity should refrain from measuring a liability until adequate facts and circumstances exist to determine a reasonably estimated cost.

Once the obligation is established, the entity will accrete the liability each period until the date the ARO is to be paid. The accretion expense recorded each period is calculated using the entity’s credit adjusted risk-free rate at the time the ARO was established. At the same time the ARO is established, the estimated retirement costs are capitalized as part of the asset and subsequently depreciated over the useful life of the asset.

Oil and gas accounting can be quite complex when factoring in the impact of changes to the estimated value of the obligation and/or timing. No specific guidance exists regarding the timing in which an ARO should be reassessed, but there are specific events and circumstances that suggest when the amount or timing of the liability has changed. A few indicators include a change in the following:

- Management’s need for the asset

- Economic factors, including inflation

- Laws or regulations impacting the costs and timing of the settlement.

Oil and gas ARO example

Managing AROs through an oil & gas accounting software makes things a lot easier. However, it can still be done in Excel if an accounting software isn’t readily available yet. Below, we’ll use Excel to walk through an example of an ARO with the following characteristics:

LYPetroleum has an oil well along the southern border of the United States. At the end of the well’s useful life, LYPetroleum must consider the costs to remove the facilities and restore the land.

- In Service Date of Asset: January 2019

- Estimated Life of Asset: 30 years

- Estimated Settlement Cost: $83,000

- Credit Adjusted Risk-Free Rate: 7%

- Inflation Factor: 2%

Let’s assume the fair value of the ARO is estimated using the expected present value technique. We’ll start by applying the projected 2% rate of inflation over the next 30 years to the expected ARO settlement cost of $83,000 to arrive at a future cost of $150,343. The expected future cash flow is then discounted by the entity’s credit-adjusted risk free rate. In this case, the rate is 7%. While significant judgment is generally required to determine if an ARO exists, for the sake of our example we’ve kept it simple. ASC 410 addresses some of the various factors to be considered when evaluating an agreement or event for the presence of an ARO in section 410-20-55-13.

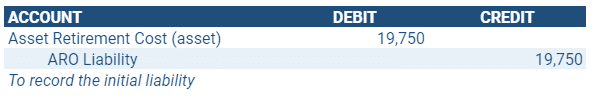

Using a present value calculation, the initial ARO liability and asset would be measured at $19,750, and the following entry is recorded:

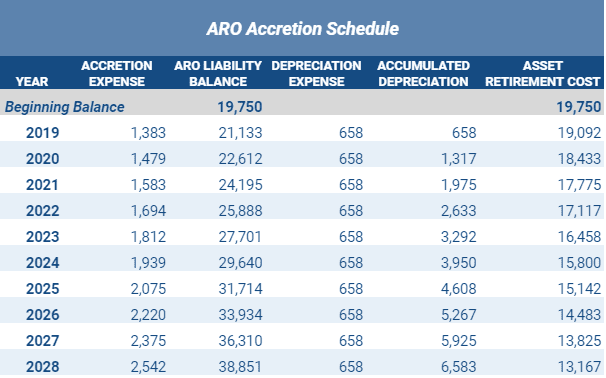

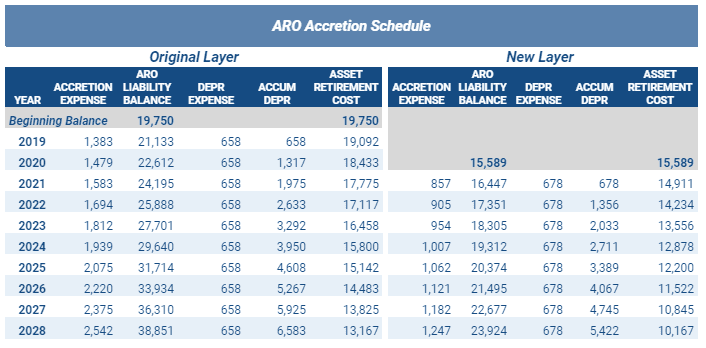

Subsequently, LYPetroleum will recognize periodic accretion expense using the initial credit-adjusted risk-free rate, offset by an increase to the ARO liability. On the other hand, the asset retirement cost asset will be depreciated over the useful life of the asset. Below is a snapshot of the accretion schedule capturing the next 10 years of the asset’s total useful life of 30 years.

We have now established a liability for an ARO 30 years in the future. Pragmatically, the next question to ask is – How is the ARO liability impacted due to changes in estimate caused by either amount or timing?

ASC 410-20-35-8 addresses accounting for both increases and decreases in the amount and timing of an ARO. Let’s review the scenarios below for examples of each.

Increase to expected cost

When the expected settlement costs increase, the amount in excess of the initial estimate, or the upward revision, is discounted using the current credit-adjusted risk-free rate, and treated like a new ARO. Each subsequent increase is added as a new layer of the ARO using the same accounting treatment.

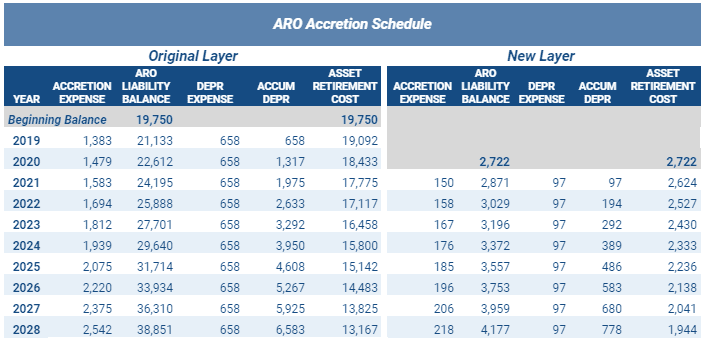

Considering the same facts noted above, let’s assume at the beginning of year three a change in circumstances increases the expected settlement costs to $90,000. This represents a $7,000 ($90,000 – $83,000) increase from the original projected costs. The increase is measured at fair value and will represent a new layer. The schedule we established above for the original projection remains intact.

If the current credit-adjusted risk-free rate is 5.5% in 2021 (still assuming a 2% inflation rate), the new ARO is measured at $2,722.

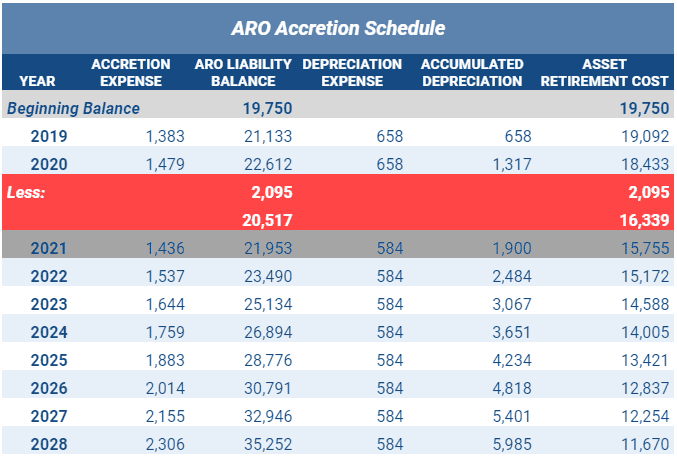

The accretion schedule establishes the new layer of ARO for the upward adjustment and records accretion and depreciation expense. The accretion expense of $1,733 represents the expense for both the original ($1,583) and new ($150) layer. The depreciation expense similarly combines the expense associated with both the original ARO and the new layer.

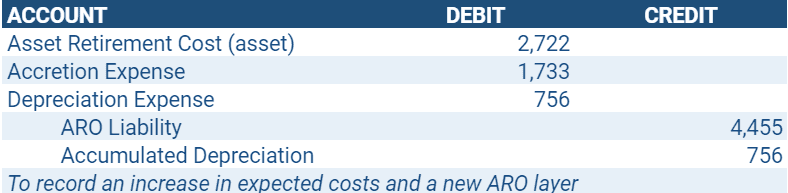

LYPetroleum records the following entry at the end of year 3 to recognize the new layer and subsequent expense for the year:

Decrease of expected cost

When expected costs decrease, adjustments are made through the existing ARO liability. A new layer is not created like in the scenario above where our expected costs increased. As such, an updated credit adjusted risk free rate will not be used in the downward adjustment scenario. Downward revisions to the expected cash flows are discounted using the rate applied at the initial measurement date.

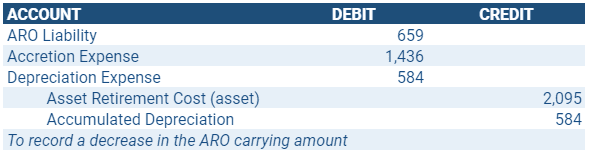

Again, considering the same facts and circumstances noted above, let’s assume at the beginning of year three a change in estimate decreases the expected settlement costs to $75,000. The $8,000 ($83,000 – $75,000) decrease, discounted at the 7% initial credit adjusted risk-free rate, reduces the carrying amount of the ARO liability at the effective date of the change.

According to the ARO accretion schedule below, the ARO liability immediately prior to the revaluation is $22,612. Reducing the ARO liability by $2,095, the present value of the $8,000 decrease, arrives at a total ARO liability of $20,517 ($22,612 – $2,095). The offset to the decrease in the ARO liability is a decrease to the asset. The accretion expense is then calculated by multiplying the total ARO liability as of the effective date of the change ($20,517) by the 7% credit-adjusted risk-free rate.

LYPetroleum records the following entry at the end of year 3 to recognize the downward revision and subsequent expense for the year:

Extension of expected settlement date

ASC 410 does not provide explicit guidance on how to remeasure the ARO liability for a change in the expected settlement date only. Therefore, companies may decide to use a current rate or the initial discount rate. The selected approach should be applied consistently to similar changes. For the sake of our example, let’s apply the credit-adjusted risk-free rate at the time of the change in estimate.

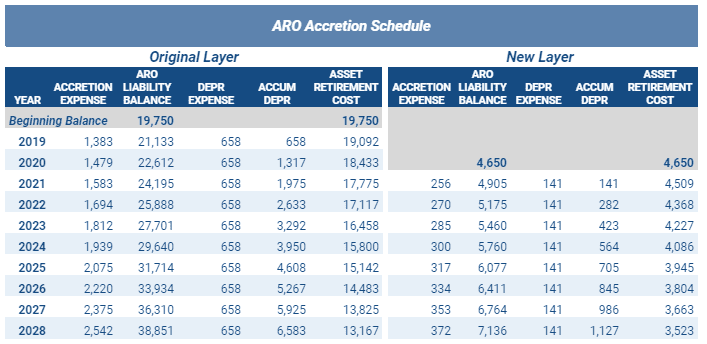

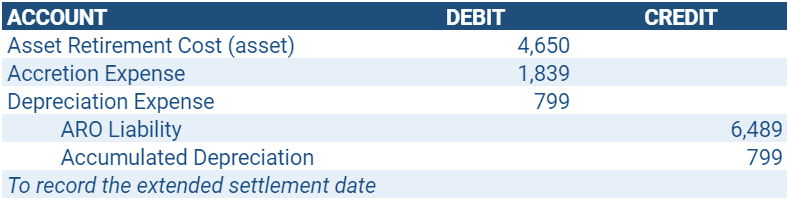

Considering the same facts and circumstances noted above, let’s assume at the beginning of year 3 the settlement date is extended by 5 years. Now the settlement date will be December 31, 2053. If the current rate is 5.5% (still assuming a 2% inflation rate), the ARO liability will be measured at the present value of $83,000 over 33 years (the original 30 years less the 2 years that have passed plus the 5 year extension), or $27,262. This results in a $4,650 ($27,262 – $22,612) increase in the carrying amount of the liability. For purposes of our example, we’ll show this as a new ARO layer:

Note in this example the direct impact discount rates have on the ARO liability. We might expect a change extending the expected settlement date would create a decrease in the ARO, similar to that of a change decreasing the expected settlement cost. However, circumstances such as the inflation rate over time or a change in the credit-adjusted risk free rate could cause the balance to increase like our scenario above. As such, a new ARO layer is necessary.

LYPetroleum will record the following entry at the end of year 3 to recognize the extended settlement date and subsequent expense for the year:

Reduction of expected settlement date

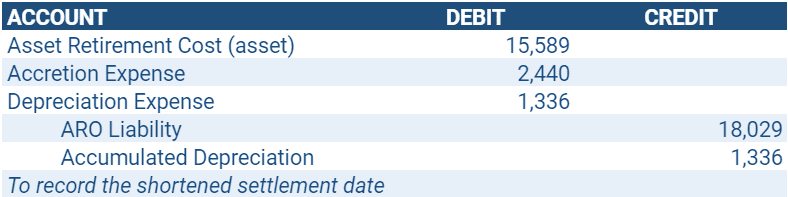

Similarly, as indicated above, any change to the expected ARO settlement date must be applied consistently. Therefore, in this scenario let’s also apply the credit-adjusted risk-free rate at the time of the change in estimate.

Again, considering the same facts and circumstances noted above, let’s assume at the beginning of year three the settlement date is shortened by five years. Now the settlement date will be December 31, 2043. If the current rate is 5.5% (still assuming a 2% inflation rate), the ARO liability will be measured at the present value of $83,000 over 23 years (the original 30 years less 2 years that have passed less the 5 year reduction), or $38,201. This results in a $15,589 ($38,201 – $22,612) increase in the carrying amount of the liability. For purposes of our example, we’ll show this as a new ARO layer:

As a result of the shortened settlement date, LYPetroleum will record the following journal entry at the end of the year 3:

Summary

Oil and gas companies frequently encounter AROs due to the nature of their business. Accounting for AROs requires significant judgement both at the initial measurement of the ARO and when accounting for subsequent revisions to the estimated amount or timing of the ARO.