A growing number of organizations are significantly underestimating their prepaid expenses, potentially causing inaccuracies in financial reporting that can lead to suboptimal strategic decisions and compliance issues. To ensure your organization isn’t subject to these risks you need to understand what constitutes a prepaid and then take a systematic approach to finding and quantifying them in your organization.

What constitutes a prepaid?

A prepaid expense is a payment made for goods or services before they are actually received or consumed. These are initially recorded as assets on the balance sheet. Common examples in many organizations include:

- Prepaid rent

- Prepaid insurance premiums

- Annual software subscriptions

- Prepaid advertising or marketing campaigns

- Maintenance contracts paid upfront

- Legal retainers

- Prepaid interest

- Estimated tax payments

Why you may be underestimating your prepaids

The shift in how organizations acquire many goods and services is causing a notable rise in prepaid expenses. Consider that Software-as-a-Service (SaaS) applications like Salesforce, Zoom, Slack and more, are now integral to most organizations. Forrester estimates that the average company utilizes a staggering 367 SaaS applications. From CRM and project management to marketing automation and communication tools, these platforms are often paid for in advance – frequently on annual subscriptions for cost efficiency. That makes them prepaids.

Yet, FinQuery surveys reveal a concerning disconnect with Forrester’s numbers. The majority of accountants surveyed estimated their organization’s total prepaids to be less than 250. There are a variety of reasons for this disconnect including:

- Growth in subscription-based goods and services

- Decentralized procurement

- Manual contract management and accounting processes

- Limited communication between teams

Whatever the reasons, this gap highlights a potential blind spot, a failure to fully recognize the multitude of prepaid subscriptions silently impacting our balance sheets.

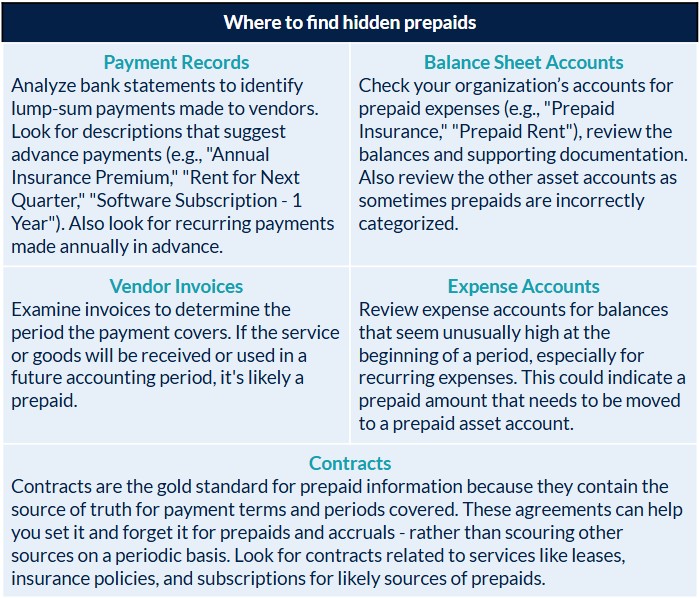

Where to look for hidden prepaids

The good news about hidden prepaids is you have access to clues that will help you find them. Here’s where to look:

How to track prepaids on an ongoing basis

Prepaids are not static. Just because you have uncovered your hidden prepaids today, doesn’t mean your organization won’t have more or different prepaids tomorrow. Take these steps to set yourself up for long term success:

Communicate with different departments

- Accounting Department: If you are not the sole owner of prepaid accounting at your organization, talk to your peers about their processes for identifying and recording prepaid expenses. Also speak with AP to determine a process for them to flag potential prepaids to you if such a process does not already exist.

- Operations/Administrative Departments: Engage with departments like IT, procurement, marketing, and operations. These departments often initiate payments for rent, insurance, software, and other services. Ask specific questions about advance payments. They can provide contracts with information about payment schedules and the periods covered. If they do not have the contracts they likely can still provide information.

- Purchasing Department: If you have a procurement department, it is likely they handle many vendor contracts and payments and can provide contracts with details on advance payments.

Implement a system for tracking prepaids

To ensure accurate and ongoing estimation, make the identification of prepaid elements a standard part of your invoice processing and payment approval workflows. This includes:

- Create a Documentation Policy: Establish a policy requiring clear documentation (invoices, contracts) for all prepaid payments, explicitly stating the period covered.

- Designate Prepaid Accounts: Use specific asset accounts to record different types of prepaid expenses (e.g., “Prepaid SaaS,” “Prepaid Marketing”).

- Reconcile Regularly: Periodically review and reconcile prepaid asset account balances with supporting documentation to ensure accuracy.

- Leverage Accounting Software: Automate the process to save time and prevent human error by using software, like FinQuery Prepaid and Accrual Accounting, to track prepaids, automate amortization, and generate insightful reports. FinQuery’s solution is unique in that you can use invoices or contracts to track and account for your prepaids making it more flexible and efficient than ERP and other market solutions.

Summary

Failing to properly identify and track prepaid expenses can lead to skewed profitability analysis, suboptimal strategic decisions, distorted financial statements, and even potential compliance issues. The growth of subscription-based services and decentralized purchasing has created the need for a more proactive, systematic approach to prepaid management. By following these steps, an organization can effectively estimate the number and value of its prepaid expenses, leading to more accurate financial reporting and better financial management. Leveraging tools like FinQuery, make it easy to ensure your organization keeps pace — and stays confident in the accuracy of its financial reporting.