Historically accounting has been a business function slow to adapt to changes and trends. Many of us did not expect to see a fully remote work environment in the accounting industry in our lifetime. However, recent technological advances are making an impact on every aspect of business.

The digital transformation shot forward with unprecedented speed in the wake of COVID-19 and the need for everyone everywhere to find new ways of doing their job, running errands, or educating the next generation. The accounting profession is also impacted by technological advances not driven by the global pandemic. We have identified the top biggest digital trends in accounting for 2022:

- Cloud-based software/Remote accounting

- Automation/AI

- Crypto/Blockchain

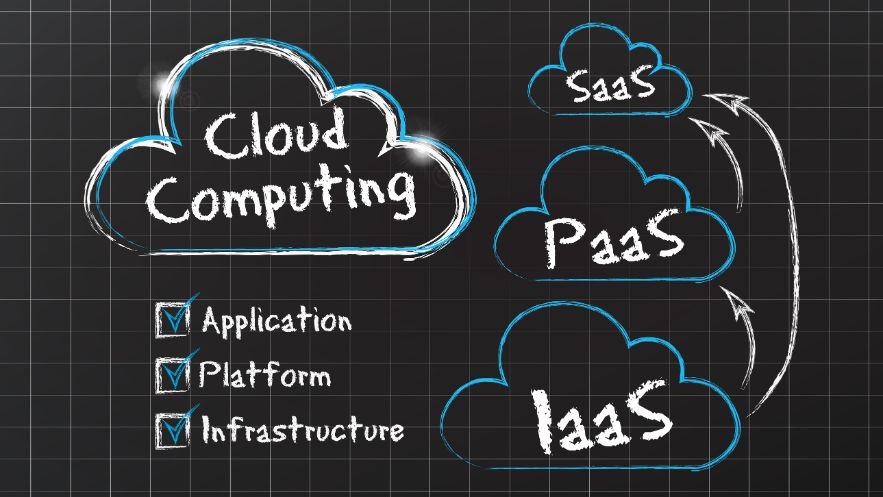

Cloud-based software/Remote accounting

The accounting market was valued at $12 billion by 2020 and is expected to grow to almost $20 billion by 2026. To say accounting software solutions are increasing at a rapid pace is not an understatement. And while the availability and use of software is rising, many companies are looking to decrease their technology spending, specifically in finance and accounting. One driver for the reduced spending on software is cloud computing. Paying for a subscription or use of a solution is less costly than purchasing and then installing software.

If you are leery about investing in cloud-based software, use applications like Gmail, Facebook, and TurboTax, you are already there. Cloud-based software allows a user to access the software from anywhere they have an internet connection. As early as 2020, 54% of CFOs expected to offer remote work permanently to their employees. The increase in cloud computing options will support this shift.

Cloud solutions are great for personal networking, communication, and, for businesses, storing and accessing large amounts of data. Cloud-based software enables you to enter data and view your changes in real-time. Additionally, you won’t have to worry about sharing documents via email or uploading them onto a zip drive – multiple people can access the items in cloud-based software and view, comment, and make changes as needed.

Automation/AI

Studies show that 86% of the tasks carried out by accountants can be automated. This doesn’t mean that your job will be replaced by a machine – in fact, automation allows you to divert your efforts from manual labor like data entry to the “service aspect of [your] business, along with ways to increase revenue,” according to Firm of the Future.

What are some of the tasks that automation can remove from your plate?

- Data entry and processing

- Document collection

- Bill payments

- Repetitive calculations

- Reports and journal entries

According to Accounting Today, the rise of automation allows accountants to “go from collecting data to making decisions faster.” Though the increase in digital technology can be daunting, this new tech will eventually become as ubiquitous as Excel.

AI in accounting goes hand in hand with the shift towards automation. In a data-driven environment such as accounting, and more specifically the data entry and paper processing functions of accounting, AI is a large component of automation. It may be a chicken vs egg question, but with the increase in automation also comes the increase in the use of AI. A recent survey shows over 60% of accountants are using or plan to use AI in their jobs in the next three years.

Cryptocurrency/blockchain

In this day and age, disruptive technology reigns. Blockchain is one such technology – a system that tracks cryptocurrency transactions using a cloud-based network. Though it can be reviewed by multiple people, as Block Geeks writes, Blockchain is “resistant to modification of the data.” It is “an open, distributed ledger that can record transactions between two parties efficiently and in a verifiable and permanent way.”

The appeal of this technology, created by Satoshi Nakamoto (widely thought to be a pseudonym of a person or persons), looms large. The increase in the use of cryptocurrencies and its shift towards the mainstream as more and more legitimate companies invest, only means the increase in blockchain technology as well as the mechanism for monitoring crypto transactions.

Additionally, the rise of blockchain, like cloud-based tech and automation, will require accountants to learn as much as they can about the technology. As more companies record transactions in blockchain, the need for accountants and auditors to review those transactions follows. The Big Four already offers some blockchain services, with national, then regional and smaller accounting firms sure to follow.

Bring it all together

The technology listed above can help accountants increase efficiency, improve data security, and save thousands of dollars per year. While the move towards online processes may seem daunting or even unnecessary, it’s important to remember that the push towards digitalization is an industry-wide initiative.