Your ASC 842 Adoption Kit

Private companies and not-for-profit entities reporting under FASB must implement ASC 842 for reporting periods beginning after December 15, 2021.

It’s time to transition to ASC 842!

Let’s get going, we’ll lead the way!

FASB Transition Guide

How will you get to your destination? This step-by-step guide will help establish where you are now and lead the way to your future destination.

Free ASC 842 Software

Create your free account to access LeaseGuru – our lease accounting software that makes it easy to account for up to 15 leases under ASC 842.

Operating Lease Accounting

Inaccurate lease accounting will quickly extinguish your compliance flame. This article details how operating leases are accounted for on the balance sheet.

Lease Identifier Tool

Pinpoint all your leases. This tool will help you determine whether or not you have a lease or embedded lease that needs to be accounted for under the new standards.

ASC 842 Disclosure Requirements

Preparation is key. This article defines the disclosures required for ASC 842 and how technology can efficiently generate those requirements and keep your lease accounting operating smoothly.

Interest Rates under ASC 842 Explained

This article will cover the various discount rate options available to lessees under ASC 842.

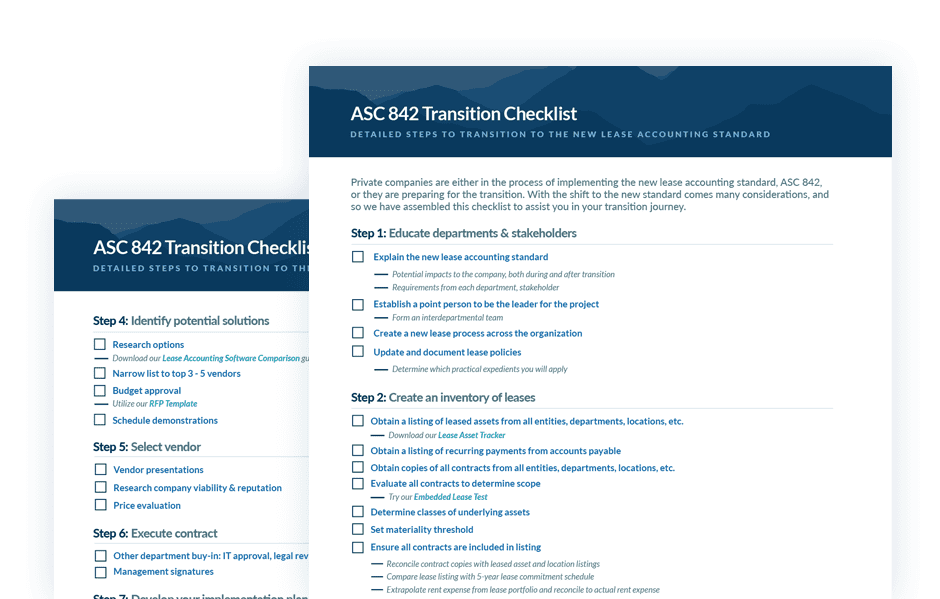

Get our free checklist for transitioning to ASC 842

Private companies are either in the process of implementing the new lease accounting standard, ASC 842, or they are preparing for the transition. With the shift to the new standard comes many considerations, and so we have assembled this checklist to assist you in your transition journey.

LeaseQuery gives you the technology, accounting knowledge, and support you need to achieve compliance and gain financial insights.