As for rightsizing, 31% of survey respondents are reducing their overall real estate footprint now. Another 22% expect their lease portfolio will be smaller next year, according to The COVID-19 Lease Impact Report: How Companies are Navigating Lease Accounting’s New Normal. LeaseQuery based this report on a survey of more than 400 accounting and finance executives.

“For accounting and finance executives in 2020, real estate and leases are in the crosshairs for cost-cutting in response to the rise of the remote workforce, shifts in demand and declines in traditional commerce,” said George Azih, CEO and founder of LeaseQuery. “Physical footprint decreases may be partially offset by increases in 2021, but it’s unlikely that real estate will return to pre-COVID 2019 levels. More than ever, companies are adopting lease renegotiation and rightsizing to generate cash flow and liquidity.”

Roughly one-third of companies report asking for rent concessions in 2020. The impact is particularly pronounced in hard-hit industries—92% of restaurants and 54% of retailers asked for rent concessions as a direct result of the pandemic.

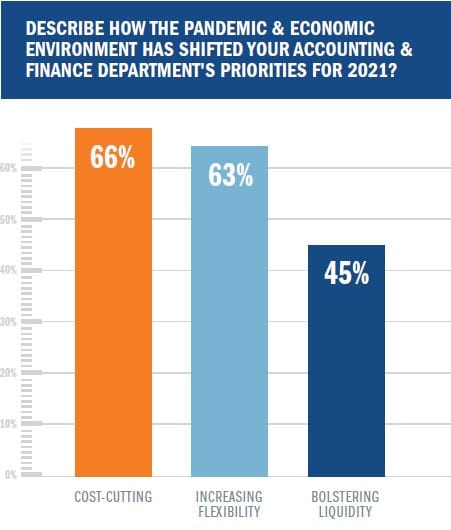

Increasing flexibility will also drive many companies to renegotiate terms this year. Roughly one in three companies are renegotiating leases for more favorable terms. When asked what the most important factor was in negotiating terms for next year, 35% of finance leaders cited exit clauses and 29% pointed to contract duration.

Key survey findings also include:

- Access to capital – Optimization efforts in 2021 will help companies bolster their liquidity, which 45% of companies note as a bigger priority following the pandemic.

- Insight to make critical business decisions – Real-time insight into financial information is highly sought after due to the pandemic and economic environment. In fact, 34% say enhancing data visibility and 38% say investing in technology are bigger priorities for 2021.

- Prioritizing accurate, on-time financial reporting – Among survey respondents, 85% say implementing the new lease accounting standard remains the same or a greater priority, and 94% say financial reporting compliance remains the same or a greater priority.

Azih added, “In a time of continued volatility and emerging risk, it’s incredibly valuable to optimize what companies can control. Businesses should continue their path to recovery and growth by refining their lease strategy and readying for compliance with the new lease accounting standard as soon as possible.”

For more information, read the full report: The COVID-19 Lease Impact Report: How Companies are Navigating Lease Accounting’s New Normal.

About the Survey

The COVID-19 Impact Report: How Companies are Navigating Lease Accounting’s New Normal is based on LeaseQuery’s Lease Portfolio Survey developed in partnership with Encoursa, which polled 443 accounting and finance executives at public and private companies, nonprofits and government organizations across industries in October 2020.

About Encoursa

Encoursa provides quality continuing professional education to CPAs. Encoursa hosts NASBA-accredited CPE webinars for growth-oriented professionals looking for high-quality, affordable continuing education. To do this, Encoursa partners with leading companies who choose to present their solutions to CPAs and finance professionals in a live, educational format. Encoursa also features presenters who speak on topics such as ethics and financial statement preparation. Visit encoursa.com to learn more.

About LeaseQuery

LeaseQuery helps more than 10,000 accountants and other finance professionals eliminate lease accounting errors through its CPA-approved lease accounting software. It is the first lease accounting software built by accountants for accountants. By providing specialized consulting services in addition to its software solution, LeaseQuery facilitates compliance with the most comprehensive regulatory reform in 40 years for companies across all sectors.

Additional Resources

- Learn more about LeaseQuery

- Follow LeaseQuery on LinkedIn, Facebook and Twitter

- Read LeaseQuery’s blog articles