The US Financial Accounting Standards Board (FASB) recently completed its Post-Implementation Review (PIR) of ASC 842, the US lease accounting standard. While you may be focused on your own FRS 102 transition for operating leases, there are critical, high-cost lessons the US market learned that can help your company prepare for its own major overhaul.

Unexpected cost: Systems and processes

The biggest takeaway from the US change is that the implementation and ongoing compliance costs for lessees were significantly higher than anticipated. The FASB had expected existing systems and processes to be largely adequate, but this proved to be a major misjudgment.

- System Inadequacy: Companies found that their existing systems and processes were often not able to account for operating leases on the balance sheet.

- New Resources Required: Entities needed to purchase new lease accounting software or make major enhancements to their internal systems to handle the comprehensive recognition and measurement model.

- Ongoing Costs Persist: The ongoing costs to apply the requirements (system maintenance, updating processes, additional personnel) remain higher than anticipated.

The Lesson: Do not assume your current contract management and accounting systems are sufficient to handle the new lease accounting rules. Begin your research on new systems and processes now and budget for software solutions and implementation support to make the change.

Lease identification is a challenge

The new requirement to bring all operating leases onto the balance sheet created a massive data collection and validation effort that was much more time-consuming than expected.

- Comprehensive Contract Review: Lessees had to perform a comprehensive review of existing contracts, beyond leases, to identify the complete population of leases and their terms.

- Embedded Leases: The updated standard placed emphasis on identifying embedded leases—contracts that contain a lease component but aren’t labelled as a “lease” (e.g., contracts for services that give you the right to control an identified asset). This was a source of significant cost and complexity.

- Strengthened Controls: Many entities noted that they had to establish more robust internal controls and processes around their leasing and procurement activities just to comply.

The Lesson: Start your lease and contract inventory immediately. Focus on identifying and extracting key data points—especially for non-traditional contracts that may contain an embedded lease. This up-front effort is essential to feed your new accounting systems accurately.

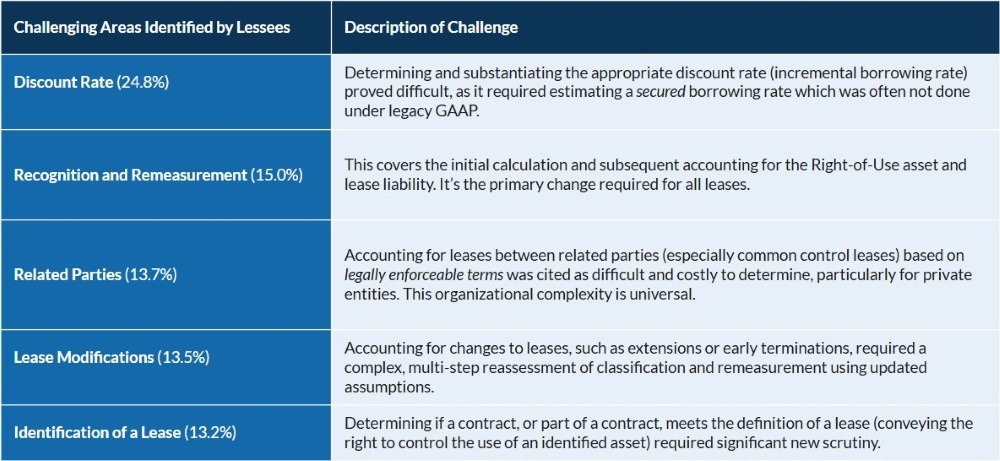

Key areas of application difficulty

US lessees reported that some specific areas of the accounting guidance were particularly challenging to apply, even those that seemed conceptually simple. In good news, FRS 102 is its own standard, but in bad news, a number of the same difficult elements are still present. Per the US experience, these areas will require significant judgement or new, repeatable internal processes.

The Lesson: Prioritise training and process development in the most challenging areas. Secure expert advice early, particularly around developing a robust, auditable process for determining the incremental borrowing rate for your lease portfolio.

The silver lining: Better information

Despite the higher than expected costs, there was a benefit that lessees noted: the standard resulted in enhanced understanding of finance.

- Better Exposure View: Many preparers noted that implementing the standard helped them better understand their exposure to leases and the key terms/conditions of their contracts.

- Improved Management Information: Academic research suggested that the changes led to better quality information available to management, which in turn led to better operating decisions and financial performance.

The Lesson: View the compliance cost as an investment in better business intelligence. The process of deep-diving into your contracts and centralising data will ultimately improve contract management, procurement processes, and give management a clearer, more faithful representation of your organisation’s financial obligations.

Next Steps: Don’t wait until the compliance deadline hits. Review the US lessons on cost, resource needs, and data challenges to ensure your FRS 102 transition is as smooth (and cost-controlled) as possible.