The mandatory effective date for lease accounting changes to FRS 102, which will bring most operating leases onto the balance sheet, is set for 1 January 2026. With what feels like plenty of time, it’s tempting to push this transition to the bottom of the priority list. However, data from US accountants who recently underwent a similar transition to their own standard, ASC 842, offers a warning: procrastination is a mistake.

The transition may be more difficult and time-consuming than you anticipate. Let’s look at the lessons UK accounting teams can learn from their US counterparts.

Perception vs. reality: The transition is harder than you think

When US companies were in the early stages of their transition, they were overly optimistic about the challenge ahead. A FinQuery survey conducted during the 2019 ASC 842 transition found that only 37 percent of companies in the early stages anticipated that their transition would be difficult. However, reality painted a very different picture. By the later stages of the transition, 67 percent experienced difficulty. This significant gap between expectation and reality shows that companies tend to underestimate the complexity of the task until they are deep into the process. For UK accountants, this is a clear signal that the FRS 102 lease accounting transition journey could be rockier than it appears from the outset.

The practical changes: Staffing and balance sheet impact

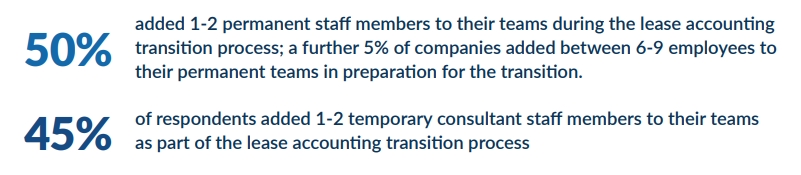

The underestimation of the workload led to a scramble for resources. In a 2021 FinQuery survey, US companies reported they needed more hands on deck than planned.

Beyond the operational strain, the financial impact was massive. The new standards fundamentally change the balance sheet. A 2021 FinQuery analysis of nearly 1,000 US organisations found the average increase in lease liabilities was 419%. The impact varied, with private companies seeing a staggering 13x increase in average lease liabilities, compared to a 4x increase for public companies.

UK companies should prepare now for similar significant impacts on their financial statements and the need to communicate these changes to stakeholders.

The silver lining: Why starting early pays off

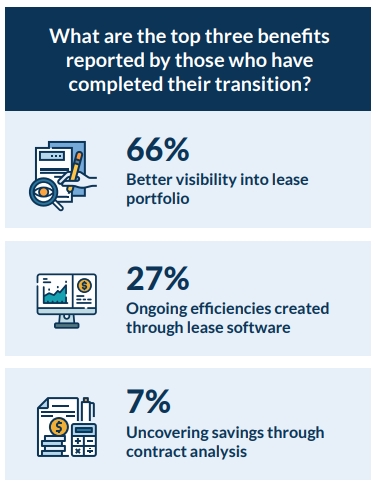

While the transition was more challenging than expected, in the 2021 FinQuery survey US accountants reported unexpected benefits after implementation. The process forced a level of discipline and centralisation that ultimately created value. The top three reported benefits were:

By gaining a clearer view of their entire lease portfolio, companies could identify savings and efficiencies that were previously hidden. Starting the FRS 102 transition process early doesn’t just mitigate the risks of a last-minute rush; it accelerates your team’s ability to unlock these strategic advantages. The sooner you start, the sooner you can turn a compliance burden into a business benefit.

Need help getting started? Check out our FRS 102 Lease Accounting Transition Guide for a step-by-step approach.