LeaseQuery recently asked over 200 accountants what technology they need to gain efficiencies and optimize workflow. Our Annual Accountants Survey: Top Challenges & Tech Wishlist provides insights into the ways the accounting industry views and uses technology. This wishlist came just in time for the holiday season. While it may not be at the top of your personal wishlist, the technology on this list will make accounting processes much simpler.

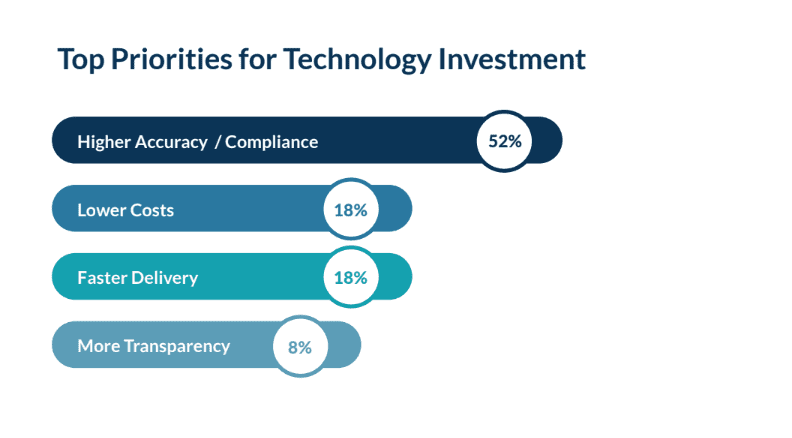

Top priorities for tech investment

According to the survey, the top priority for tech investment is improved accuracy and compliance. The new lease accounting standards are a prime example of where technology can enable accurate accounting and compliant financial statements. Nearly two out of three of the accountants surveyed report they are developing or behind in their technology journey. To have a holly jolly lease accounting transition, accountants need to implement accounting technology to make the process as efficient as possible.

Cloud adoption

Tis the season for cloud adoption! When asked if their data was transferred to the cloud, a large chunk of respondents said they are either in the process of transferring data to the cloud or planning to. In our survey, only 38% of accountants reported they are fully transferred to working in the cloud. Without your data in the cloud, you are at risk of falling behind.

Cloud-based accounting software enables the sharing of documents and information across departments and locations easily. Ensure your leases are stored in a secure, centralized, and easily-accessible location by using a lease accounting software in the cloud.

Lease accounting technology

Jingle all the way to compliance with the right lease accounting technology. Less than half of the accountants surveyed report using technology for lease accounting. Using spreadsheets and entering data manually is risky. Avoid non-compliance and prevent financial statement errors by finding reliable lease accounting software to facilitate adoption.

Audit technology

Technology that helps facilitate and simplify an audit is a growing investment among accountants. Remote audits during the COVID-19 pandemic adjusted the way we navigate the auditing process. Implementing technology that auditors can also use saves time during the stressful process. Companies can easily document requests and simplify communication within the solution. Only 23% of the surveyed accountants are using technology to support audits. The rest are missing out on the benefits.

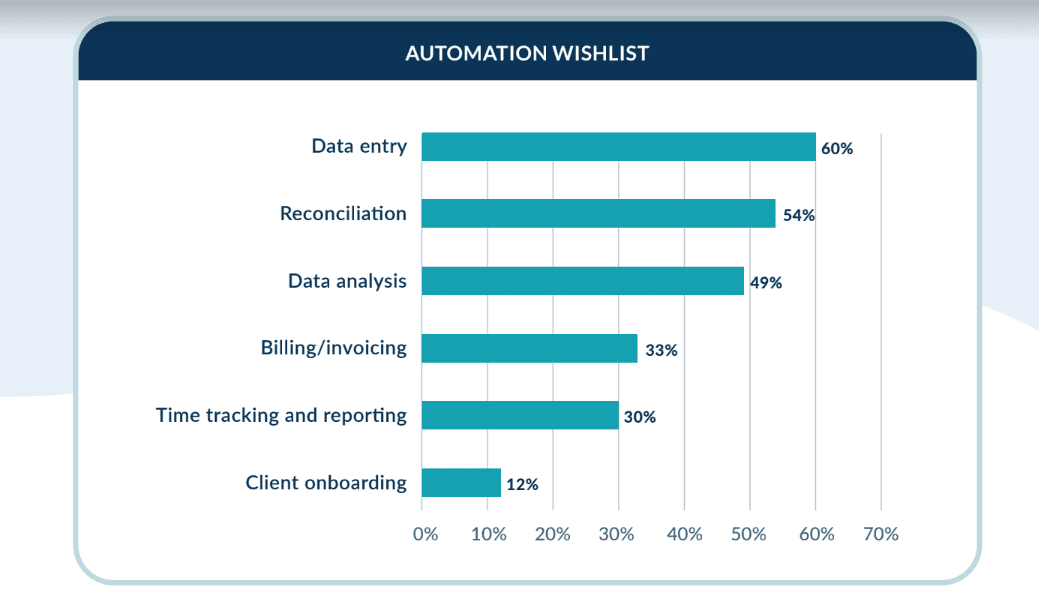

Automation

The hottest item on this year’s technology wishlist is automation. Accountants are on board with anything that simplifies the accounting process. Automation frees up time by replacing manual tasks from data entry to time tracking, so accountants can focus on more important tasks.

Specifically, accountants want automated technology for the dreaded task of data entry. Automation also reduces human errors and speeds up reconciliations. According to the wishlist survey results, it looks like accounting teams around the world will do whatever it takes to stay on the nice list if Santa (or the right accounting technology provider) can promise an automated solution under the tree this year.

Summary

The right accounting technology will automate processes and provide full compliance in the blink of an eye. Accurate lease accounting saves time and money. Give your company the gift of accounting efficiency this holiday season and ring in the New Year with LeaseQuery.